According to experts in this particular area of property investment, the rise in number and quality of services offered, eg. golf courses and marinas, as well as the improvement of connectivity by air or by car to areas of interest, are all factors that will contribute to the rising value of luxury holiday properties in Greece in the following years. As a result, many interested buyers feel that acquiring luxury properties in Greece can result in considerable profits from future sales.

“The resale value is an important factor for those who are looking to invest €4-5 million to acquire luxury holiday villas in Greece”, says Mr. Savvas Savvaidis, CEO of Greece Sotheby’s International Realty. In addition, a luxury property in Greece has inherent advantages specific to the location, when compared to those in other Southern European countries with similar characteristics.

“Greece is one of the last eco-heavens in developed Europe. Its unspoilt nature and pleasant climate are not readily available elsewhere. The quality of life is high, as is the quality of construction of the available properties, which conforms to the strictest international standards”,

says Mr Savvaidis. Compared to similar properties in other countries, Greek locations offer very interesting buying opportunities, a fact compounded by the anticipated return of the Greek economy to normality and sustainable growth.

It is interesting to note that international investors tend to compare real estate prices of properties in similar locations in different countries. These locations have similar characteristics that make property values comparable. For example, Mykonos can be compared to Ibiza in Spain, while Corfu is more similar to Mallorca.

Mykonos is less expensive, while nightlife is on a par with Ibiza.

The luxury real estate market of Mykonos is directly comparable to that of Ibiza in Spain. According to Mr. Savvaidis, who has a long track record in this market segment,“both islands attract celebrities and the international jet-set because of the luxury and vibrant nightlife. Villas in both islands are usually built by leading architects and interior designers”. This is the reason behind many buyers’ comparison between the two locations.

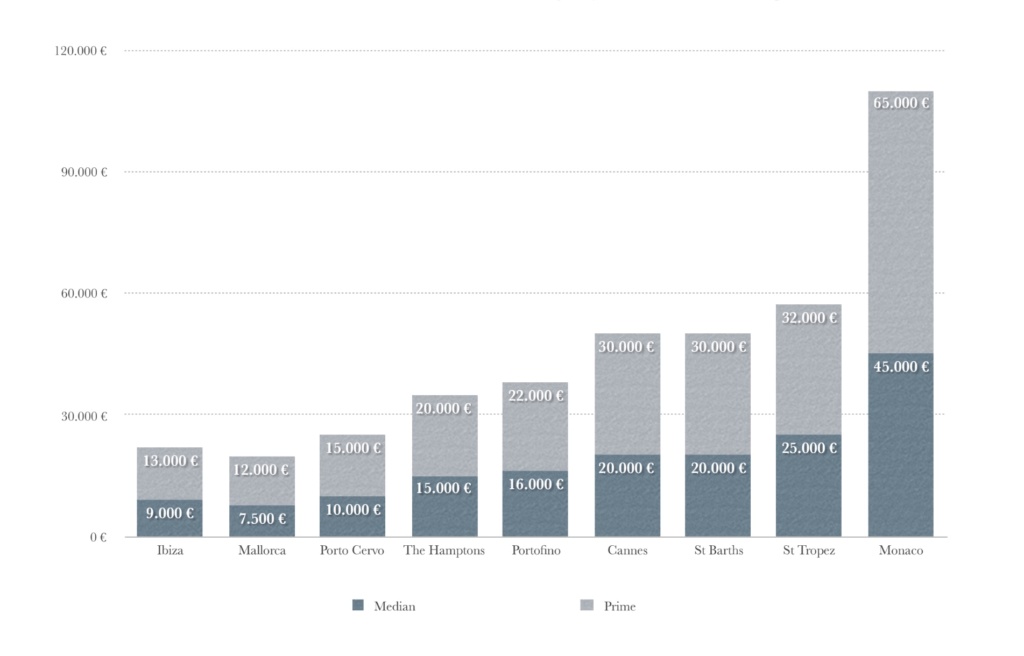

Today, the average price per square meter for a luxury villa in Mykonos is approximately €8.000 vs. approx. €9.000/sq.m in Ibiza. It is also worth noting that prices in Mykonos have not fallen in recent years, despite the economic crisis. In some cases, a moderate rising trend has been observed. Demand, although healthy, could be multiplied, were the number of available properties to increase. According to Sotheby’s data, the number of such properties available for sale in Mykonos is only 90, compared to the 300 or so available in Ibiza.

Another reason behind the upward trend in property values is that they have become an investment that can provide immediate returns in the form of rental revenue, through digital platforms such as Airbnb. The rental market has been enriched with many luxury properties that were previously only used by their owners. This trend that registers lucrative yields of even 8% in some cases is expected to be slightly adjusted on the long term, according to Mr Savvaidis, as the rapidly expanding rental market will be reaching a new balance between demand and offer. Still, the appetite for customised luxury accommodation and related services seems to be very strong as well as the very solid base of the Ultra High Net Worth Individuals made of 255,000 families worldwide with a combined net worth of $27 trillion.

Mallorca is ahead of Corfu in infrastructure

Αnother “pairing” in the luxury property market is that of Corfu with Mallorca in Spain. Both are islands of considerable size with year-round appeal. In Mallorca especially, where there is a large number of golf courses, the year-round appeal is even more evident. Both islands also share an aristocratic heritage. Corfu was the preferred summer retreat of the aristocracy, local and international, while Mallorca was the summer destination of Spanish royalty. This tradition has resulted in the presence of a large number of estates with extensive grounds on both islands. As Mr Savvaidis points out, the northeast coast of Corfu is also known as Kensington-by-the-Sea, echoing the name of the exclusive London borough. This part of Corfu is the preferred location of the international jet-set and is characterised by seafront properties.

In Corfu, as well as in other luxury property locations popular with international buyers, there is no concentration of any one nationality. Buyers come from all affluent countries. Swiss, English, French, Italian, Belgian and German buyers are most frequent, while in the past few years the numbers of American, Israeli, Middle Eastern buyers from the UAE, Dubai and Qatar have been on the rise. In any case, the availability of such properties in Corfu is limited to approximately 60 uniquely luxurious and exceptional options.

Porto Heli and the Hamptons: The business elite resorts

In the last few decades, Porto Heli and Ermioni in general, and Agios Emilianos in particular, have become the hub of the local and international business elite. Dozens of villas belonging to leading businessmen and politicians, eg. Latsis, Vardinoyannis and Pitsos, have been purchased or built, similarly to the Hamptons in New York, where one must own a summer house if he is to be considered a true member of the business elite.

Both areas also offer a large number of seafront estates, which are hard to find elsewhere. The Hamptons on Long Island is a group of many seaside towns, where the elite of New York moves for the summer and a number of towns further inland. Porto Heli could easily be considered similar, as there are more than one areas that one could choose as a summer retreat. According to Greece Sotheby’s International Realty, the potential buyers of luxury holiday properties are Ultra High Net Individuals (UHWI), approximately 200.000 or so people with an average net worth of 30 million dollars each. These people have 6-holiday homes on average, in different parts of the world. Unfortunately, Porto Heli does not offer a large number of properties of such a high standard. Their number is limited to 10, which brings their value up to €7.500/sq.m. compared to a median price of about €15.000/sq. m. in the Hamptons.

Article by Nikos Rousanoglou on Kathimerini Sunday Edition with the contribution of Greece Sotheby’s International Realty